Funding Rounds

Dach

Kenbi, the Berlin-based provider of outpatient care management services, raised €7m in a seed round led by Redalpine with existing investors Heartcore, e.ventures and Partech participating. Read more.

Clark, the Frankfurt-based InsurTech startup, raised €69m in funding led by Chinese tech giant Tencent. Existing investors Portag3 Ventures, White Star Capital and Yabeo also participated in the round. Read more.

Ryte, the Munich-based ‘Website Quality Management’ SaaS platform, raised €6.5m from Pd ventures, Mayflower (Germany) and Octopus Investments. SEK Ventures also participated in the round. Read more.

Energy Robotics, the Darmstadt-based developer of robotics systems designed to improve productivity, safety and data of capital-intensive industrial sites, raised €2m in seed funding led by Earlybird, alongside other prominent business angels. Read more.

Jedox, the Freiburg-based developer of a client-server software designed to create business intelligence and performance management services for systematic data analysis, raised $100m+ of funding from Insight Partners alongside existing investors Iris Capital, eCAPITAL, and Wecken & Cie. Read more.

Sennder, the Berlin-based digital road freight forwarder, raised $160m in Series D financing, surpassing a $1bn valuation. New unnamed investors led the round, which also involved all of Sennder’s existing investors, overall including Accel, Lakestar, HV Capital, Project A and Scania. Read more.

France

YZR, the Paris-based startup which is on a mission to reduce time spent correcting and editing data, raised €2m in seed funding led by a well-known consortium of French Angel investors: Anne-Laure Constanza (Envie de Fraise), Bertrand Diard (Talend), Frédéric Mazzella (Blablacar), Jean-Baptiste Rudelle (Criteo), Laurent Ritter (Voodoo), and Arnaud Mauduit (Sekko Mono). Read more.

iziwork, the Paris-based developer of a fully digitalized and committed temporary employment platform, raised $43m in funding from Cathay Innovation and Bpifrance. Read more.

UK

Humn.ai, the London-based developer of an insurance platform designed to offer fleets with real-time risk management insights and insurance pricing, raised an undisclosed amount of venture funding from Shell Ventures and Marbruck Investments. Read more.

Xampla, the Cambridge-based producer of plant-based materials products, raised £6.2m of seed funding led by Horizons Ventures. Amadeus Capital Partners, Cambridge Enterprise, and Sky Ocean Ventures also participated in the round. Read more.

Curve, the London-based FinTech firm that combines multiple cards and accounts into one smart card and an app, raised $95m in Series C funding. The round was led by IDC Ventures, Fuel Venture Capital and Vulcan Capital with participation from OneMain Financial and Novum Capital. Read more.

Checkout.com, the London-based developer and operator of an online payments platform, raised $450m (at a $15bn valuation) led by Tiger Global. The London-based company’s valuation is almost triple the $5.5bn of last year’s round. Read more.

Gett, the London / Israel based travel SaaS platform that is transforming corporate ground travel, raised $115m led by Pelham Capital Investments with participation from unnamed existing investors. Read more.

Rapyd, the London-based developer of a API-based “fintech-as-a-service” platform covering payments, banking services, fraud protection and more, raised $300m in Series D funding at a $2.5bn valuation. The round is led by Coatue, with Spark Capital, Avid Ventures, FJ Labs and Latitude, as well as General Catalyst, Oak HC/FT, Tiger Global, Target Global, Durable Capital, Tal Capital and Entrée Capital also participating. Read more.

Snowplow, the London-based behavioural data management platform, raised $10m in Series A2 funding. The round was led by Atlantic Bridge, with participation from existing Series A investor MMC Ventures. Read more.

Italy

Cortilia, the Milan-based operator of an online agricultural marketplace designed to connect consumers with farmers, raised €34m of Series C funding led by Red Circle Investments. P101, Primomiglio SGR, Five Seasons Ventures, and Indaco Venture Partners also participated in the round. Read more.

Fitprime, the Rome-based developer of a fitness locator application designed to offer an online marketplace for sports centers (Italian competitor to Urban Sports Club), raised €2.5m led by Vertis, as well as previous backers LVenture Group, Italian Angels for Growth and Club degli Investitori. Read more.

Leaf Space, the Milan based provider of ground segment services designed to offer satellite communication, raised €5m of Series A funding from Whysol Investments with participation from Primo Space and RedSeed Ventures. Read more.

Finland

Surgify Medical, the Espoo-based developer of bone surgery technology, raised €1.4m of venture funding from Innovestor, Peter Lindell and Leena Niemistö. Read more.

M-Files, the Tampere-based developer of a document management software designed to help enterprises find, share and secure documents and information, raised $80m in new funding led by growth capital firm Bregal Milestone. Read more.

Others

HQLAx, the Luxenbourg-based provider of collateral lending solutions to help the market redistribute collateral liquidity more efficiently, raised €14.4m in funding from BNY Mellon, Goldman Sachs, BNP Paribas Securities Services, Citigroup and existing shareholder Deutsche Börse. Read more.

DRUID, the Romania-based developer of an AI-powered, no-code, chatbot authoring platform, raised €9m of Series A funding led by GapMinder Ventures with participation from Early Game Ventures and private investors. Read more.

Minna Technologies, the Sweden-based subscription management software tool, raised €15.5m in Series B fundraising led by Element Ventures, with support from MiddleGame Ventures, Nineyards Equity and Visa. Read more.

Intelligence

Getir, the Istanbul-based online delivery company, is in talks to raise around $100m at a valuation north of $800m.

The two German loan comparison platforms smava and Finanzcheck.de are in merger discussions.

Online greeting card retailer Moonpig said it intends to list in London, buoyed by an acceleration in online shopping amid the coronavirus pandemic.

Investors

LAUNCHub Ventures announces first €44m closing of its new fund for European startups. The fund invests in technology startups at Seed and Series A stages focusing on companies in South Eastern Europe, the broader Central and Eastern European region, as well as startups with SEE co-founders worldwide. Read more.

Cathay Innovation, a multi-stage VC partnership affiliated to Chinese cross-border investment firm Cathay Capital, closed its second global fund at €650m ($792m). Read more.

Delivery Hero launches venture capital fund DX Ventures to drive innovation in food, delivery and beyond. DX Ventures currently has initial capital of €50m to deploy globally and is fully funded by Delivery Hero SE. Read more.

Israel-based Glilot Capital Partners, typically an early-seed investment firm, has launched its first early growth fund. The new $170m fund, called Glilot+, is the firm’s fifth fund. The new fund primarily will look for post-Series A enterprise software and cybersecurity opportunities. Read more.

Orange has spun off its investment fund arm into a separate legal entity renamed as Orange Ventures with €350m worth of start-up investments. Read more.

Fun Fact

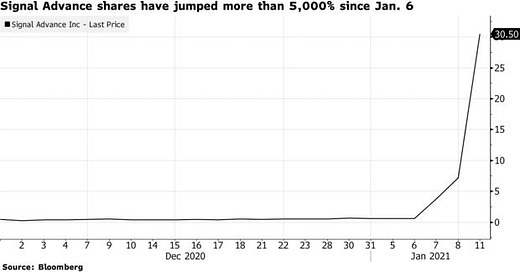

“Use Signal”, Elon Musk tweeted on Jan 7, apparently referring to the encrypted messaging service. By the end of the day, Signal Advance Inc. (completely unrelated to the messaging service ‘Signal’"!) shares had surged more than sixfold giving it a market valuation of $390m. Gotta love Robinhood traders!

Thought Of The Week

After Parler was banned on both the Apple and Google app stores for failing to curb violent and threatening content on its platform, the social media site is now completely offline as a result of Amazon terminating Parler’s web hosting services. This is significant as it is the first time that B2B suppliers are acting as regulators by default. To those concerned about freedom of speech and expression on online platforms, it represents another example of extreme action by major tech companies which threatens internet freedom. This is a debate which is certain to continue beyond the Trump presidency….

New York Times journalist Jack Nicas first reported news of Apple's move.