Intelligence

Kasko2go, the Zug-based (Switzerland) auto-industry insurtech company targets a growth round of up to €35m for DACH-region and platform expansion.

Duckt, the Tallinn-based smart mobility startup, aims to raise at least €3m in a Series A round.

LatticeFlow, the Zurich-based developer of tools for assessing the quality of artificial intelligence (AI) systems, aims to raise a $10m - $15m Series A next year.

Factris, the Amsterdam-based developer of a flexible credit line platform is putting together €25m in equity and debt to fund acquisitions.

Ubamarket, the London-based retail app company, is planning a £15m-£20m fundraise in mid-2021 to support the rapid expansion of its business.

Investors

Insight Partners is pre-marketing its 12th flagship fund with a $12bn target. Read more.

Quadrille Capital, a Paris-based investor in technology and healthcare growth equity, raised €511m for its fourth technology fund. Read more.

Demi Obayomi (ex-NextWorld Capital) and Abhishek Lahoti (ex-Dropbox) joined Sapphire Ventures as vice presidents. Read more.

Apax Partners is raising $1.5bn for its second midmarket tech fund, per public pension docs. Read more.

Coatue Management is raising its second early-stage VC fund, per an SEC filing.

Sofinnova Partners closes €445m oversubscribed late-stage healthcare crossover fund. Read more.

Brunnur Ventures closes its second fund at $65m. Read more.

The Heartcore team just updated their website underlining their consumer-focused investment thesis. Also take a look at their consumer trends report - great read!

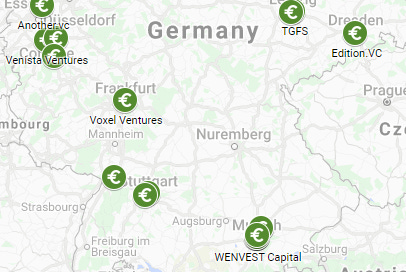

Pre-Seed Funding In Germany

Here is a detailed list of all the pre-seed investors in Germany - quite interesting!

Startup Of The Week

Product

Developer of an application programming interface technology designed to monitor the status and performance of vital site transactions.

Location

Berlin, Germany

Raised

Raised $2.25m of seed funding

Investors

Accel

Revenue Model

Freemium & Pay as you go for API / browser check runs

Funding Rounds

Dach

Instamotion, the Munich-based online platform for buying used cars, raised a €24m Series B led by G+J Digital Ventures in cooperation with the Ad Alliance. Existing investors, Earlybird and THI Investments, as well as Dublin-based ACT Ventures, also participated in the round. Read more.

nextmarkets, the Cologne-based commission-free online broker, raised a $30m Series B. The round was led by existing investors Alan Howard and Christian Angermayer with his Cryptology Asset Group. German investors such as DEWB are also among the investors. Read more.

Infarm, the Berlin-based urban farming startup, raised $100m in a fresh funding round, bringing total funding since inception to more than $400m. The latest funding, a mix of equity and debt financing, was raised from existing investors, including Hanaco Ventures and Atomico. Read more.

Hepster, the Rostock-based InsurTech platform, raised a $10m Series A led by Element Ventures. Also participating was Seventure Partners, MBMV and GPS Ventures, as well as previous investors. Read more.

Elucidate, the Berlin-based developer of a financial crime risk management platform designed to make it simple to store, manage and price financial crime through the fincrime index raised €2.5m of venture funding in a deal led by Frontline Ventures. Read more.

35up, the Berlin-based SaaS startup providing cross-selling solutions for ecommerce operations, raised a $3.3m Seed round led by Coparion and DhV ventures. Read more.

France

GetAccept, the San Francisco-based developer of a sales enablement platform founded by four Swedish entrepreneurs, raised a $20m Series B led by Bessemer Venture Partners at the end of 2020. GetAccept is now bringing in Gaia Capital Partners, an investor with extensive knowledge about the French market, to further accelerate the growth in France. Read more.

UK & Ireland

Starling, the London-based challenger bank has raised $376m at a pre money valuation of $1.5bn. The round, a series D values the company at $1.9bn post money. This latest round is being led by Fidelity Management & Research Company, with Qatar Investment Authority (QIA); RPMI Railpen (Railpen), the investment manager for the £31 billion Railways Pension Scheme; and global investment firm Millennium Management also participating. Read more.

Scoro, the London-based work management software for professional service businesses, closed a $16.4m Series B funding round led by Kennet Partners. Additional investors include Columbia Lake Partners, Inventure, Livonia Partners and Tera Ventures. Read more.

Bother, the London-based operator of an online grocery delivery start-up, raised a $6m Seed round led by Venrex. Read more.

Easol, the London-based SaaS platform that supports experiences businesses such as adventure trips, wellness retreats, festivals, sports and gives them control over driving more direct sales, raised a $4.5m Seed round from Notion Capital. Read more.

Wefarm, the London-based social networking platform aimed at independent farmers to help them meet each other, exchange ideas and get advice, and sell or trade equipment and supplies, raised a $11m Series A led by Octopus Ventures. Read more.

Nordics

Exabel, the Oslo-based provider of a simple-to-use Al, analytics and data platform for investment teams, announced it has closed a fourth seed investment round from investor AWC (formerly Awilhelmsen Capital Holdings), bringing its total capital raised to over $21m. Read more.

TradeBay, the Stockholm-based B2B marketplace for commercial fruit trading, raised a $1.1m Seed round led by J12 ventures, FJ Labs and and DHS Ventures partners. Read more.

Others

Bolt, the Tallinn-based mobility firm received €20m in funding from the World Bank’s International Finance Corporation (IFC). Read more.

Jobandtalent, the Madrid-based digital temp staffing agency startup which operates a dual-sided platform that matches temps with employers needing casual labor, grabbed €100m in Series D funding from SoftBank’s Vision Fund 2. Previous investors in the startup include Atomico, Seek, DN Capital, InfraVia, Quadrille, Kibo and FJ Labs. The company also announced $100m in debt financing from BlackRock. Read more.

Preply, the Kiev and US-based online language learning/tutoring services marketplace, raised a $35m Series B co-led by Owl Ventures and Full In Partners. Existing backers Point Nine Capital and Hoxton Ventures participated in the round. Other participants in the round include EduCapital, All Iron, Diligent Capital, Evli Growth Partners, Niklas Ostberg, Arthur Kosten, Przemyslaw Gacek and David Helgason. Read more.

What’s Your Password?

Thought Of The Week

Electric bike sales are soaring across the world. In the US, 145% more electric bikes were sold last year compared with 65% more bikes of all types. The European electric bike market alone grew by 23%. Almost 1 in 10 Dutch consumers plans to buy one this year.

E-bikes sharing schemes have also grown in popularity with each shared e-bike in New York ridden 9 times a day. Globally, cycling has seen a huge boost over the last year. 85% of Americans see cycling as more COVID-safe than public transport and cities across the world have added new bike lanes from Mexico City to London and Paris.

European countries have spent €1bn on cycling infrastructure since the pandemic began. Bike manufacturers say there was already an uptick even before coronavirus as people were already turning to healthier lifestyles and zero emission transport.